LOOKING AT THE YEAR THAT WAS

2022: SCOTCH WHISKY

Whisky is a passion to explore. From the history of the spirit to the evolution of the industry, the story of whisky helps fuel that passion. Often, it’s easy to forget that whisky is also a global multi-billion dollar industry. The stories of whisky — from news and new releases to in-depth inquires and what goes on behind the label — blend together to help us appreciate the spirit of whisky.

The Scotch Whisky Category hasn’t been without its challenges in the past 12 months. Rising costs and supply-chain issues have taken their toll in 2022, as nearly 40 per cent of Scotch whisky distillers have seen their shipping costs double. 2023 may see the nether side of the Scotch Whisky Industry.

A recent survey of the industry found that 57% of distillers have seen energy costs increase by more than 10% in the past year, with nearly a third seeing their energy costs double. And things could become worse in 2023 if the UK government goes ahead with its planned double-digit excise duty rise – a decision that has been delayed until the new year. If the decision goes in the category’s favour, the SWA says it will free up companies to continue to invest, create jobs, and help to grow the economy.

The Scotch whisky industry has previously been an economic anchor during turbulent times, and that is what the industry hopes to do again with the right government support. According to Euromonitor International, the category is projected to see a compound annual growth rate (CAGR) of 04 per cent from 2021 to 2022, up by three percentage points. This might stagnate in 2023, which would then see a mathematical loss, not physical.

Multiple Scotch distilleries broke ground in 2022, while several others submitted plans for modern builds, including Portavadie on the banks of Loch Fyne.

Dál Riata and R&B Distillers applied to build new distilleries in Campbeltown, which will almost double the region’s current capacity, something that will add to the area’s predicted renaissance: Between Glen Scotia, Springbank and Glengyle, that create more than a million litres a year, there’s more than enough scope for more distilleries, and that’s really exciting.

Blends also should not be overlooked. Sales are expected to grow by volume (reaching 86.5m cases) and value (hitting US$44.9m) by the end of 2022. And expect a repeat in 2023, Euromonitor predicts, with a volume forecast of 98.7m cases and value worth US$47.5m. There is really no growth worth mentioning for 2023.

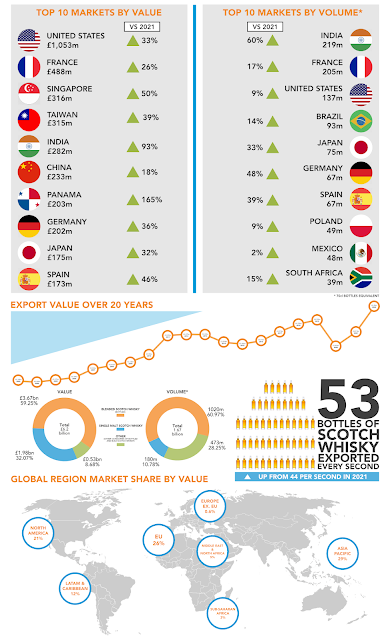

Scotch whisky exports declined in both value and volume during the first half of 2023, according to a new report from the Scotch Whisky Association. The report, based on HMRC statistics, shows a 3.6 percent decline in the value of Scotch Whisky exports over the first six months of 2023 compared to the same period a year ago. It should be noted that the first six months of 2022 set a record for both export value and volume as markets grew and restocked following the pandemic. The volume of Scotch whisky exports was down by 20 percent over 2022’s record volume.

SWA executives characterised the findings as part of a global trend toward premiumisation in the spirits category as consumers drink less, but better. According to SWA Chief Executive Mark Kent, “around the world, we continue to see the same trend – consumers drinking less overall and switching to higher quality spirits like Scotch Whisky. Premiumisation in the spirits category didn’t start during Covid-19, but the pandemic certainly accelerated the trend, and it remains the case that consumers are trading up, enjoying premium spirits, and consuming fewer units of alcohol. Scotch Whisky remains well placed to benefit from this shift.”

France reclaimed its long-standing position as the top export market by volume with 88 million (700ml equivalent) bottles, despite a 12.6 per cent decline from 2022. India, which had previously displaced France as the volume leader, recorded a 31.4 per cent decline to 72 million bottles. The United States ranked third with 59 million bottles even though overall exports were off by 14.9 per cent.

The U.S. continues to lead by value of exports with £437 million worth of Scotch Whisky imported during the first half of the year. However, that represents a 5.1 percent decline from 2022. France gained four per cent to £235 million to finish second once again, while Singapore’s role as an Asian shipping hub helped push exports up by 59 percent to £165 million. Taiwan and China both reported strong gains to round out the top five.

The premiumisation trend is most obvious in the Asia-Pacific countries, since none of those three crack the top ten in terms of value and the wider region reported a 13.5 per cent gain in export value. The European Union gained 3.8 per cent by value, while the non-EU European countries showed a 14.5 per cent gain. North America, the Middle East and Africa, and Central and South America all reported declining exports.

Scotch Whisky is a hallmark of Scotland's national heritage and identity. Exported to around 180 markets, Scotch Whisky is an important part of the Scottish and UK economies, generating billions in exports and supporting thousands of jobs. The quality and reputation of Scotch Whisky has made it one of the world’s best-known Geographical Indications. Securing the long-term sustainability of this thriving industry is the task of the industry’s trade body, the Scotch Whisky Association. The Scotch Whisky Association (SWA) is working hard to ensure the industry continues to thrive. In particular, they discuss the vital role that Scotch Whisky’s long-held GI status plays in ensuring consumers continue to enjoy genuine Scotch Whisky. They also highlight SWA’s efforts to secure access to the talent and skills the industry needs to continue to thrive, for example, through its Diversity and Inclusivity Charter.