SCOTCH WHISKY ASSOCIATION: FACTS AND FIGURES 2022

Facts & Figures

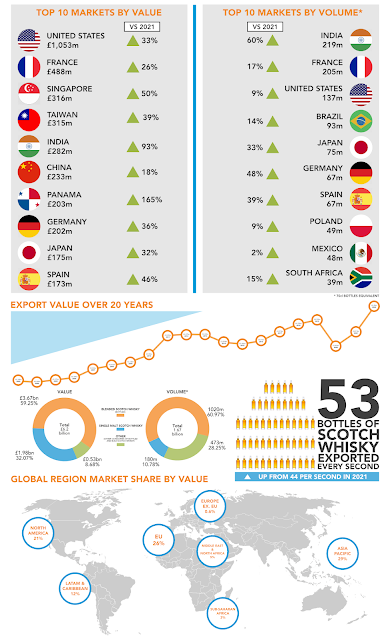

53 bottles of Scotch Whisky are exported every second to markets all over the world! There’s more about the amazing stats behind the industry.

· 53 bottles (70cl @40% ABV) of Scotch Whisky are shipped from Scotland to around 180 markets around the world each second, totalling over 1.6bn every year

· Laid end to end those bottles would stretch about 467,000kms-that's more than 11 times around the Earth!

· In 2022, Scotch Whisky exports were worth £6.2bn.

· In 2022, Scotch Whisky accounted for 77% of Scottish food and drink exports and 25% of all UK food and drink exports

· In 2022, Scotch Whisky accounted for 26% of all Scotland’s international goods exports and 1.5% of all UK goods exports

· The Scotch Whisky industry provides £5.5bn in gross value added (GVA) to the UK economy (2018)

· More than 11,000 people are directly employed in the Scotch Whisky industry in Scotland and over 42,000 jobs across the UK are supported by the industry

· 7,000 of these jobs in rural areas of Scotland providing vital employment and investment to communities across the Highlands and Islands

· Around 90% of barley requirements of the industry are sourced in Scotland

· In 2019, there were 2.2 million visits to Scotch Whisky distilleries, making the industry the third most popular tourist attraction in Scotland

· Some 22 million casks lie maturing in warehouses in Scotland waiting to be discovered - that is around 12bn 70cl bottles

· To be called Scotch Whisky, the spirit must mature in oak casks in Scotland for at least 3 years

· 148 Scotch Whisky distilleries are currently operating across Scotland as of October 2023.

All figures relate to Jan-Dec 2022 unless stated otherwise.

Scotch Whisky Exports Over £6bn for First Time

Post-pandemic restocking, the return of Global Travel Retail and premiumisation trends all contributed to growth in volume and value for Scotch Whisky in 2022.

Global exports of Scotch Whisky grew to more than £6bn for the first time in 2022, according to figures released today by the Scotch Whisky Association (SWA).

In 2022, the value of Scotch Whisky exports was up 37% by value, to £6.2bn. The number of 70cl bottles exported also grew by 21% to the equivalent of 1.67bn.

The Asia-Pacific region overtook the EU as the industry’s largest regional market, with double-digit growth in Taiwan, Singapore, India and China as the post-Covid recovery continued.

While established EU markets such as France, Germany and Spain continued their post-pandemic bounce-back with strong growth in 2022, India replaced France as the largest Scotch Whisky market by volume. Despite double digit growth, Scotch Whisky still only comprises 2% of the Indian whisky market. SWA analysis shows that a UK-India FTA deal which eases the 150% tariff burden on Scotch Whisky in India could boost market access for Scotland’s whisky companies, allowing for an additional £1bn of growth over the next five years.

In North America, the United States continued its recovery following the impacts of tariffs on Single Malt Scotch Whisky to again be the industry’s only market with exports valued over £1bn. Both Mexico and Canada also saw growth, underlining the importance of securing further market access wins through the renegotiation of the UK’s Free Trade Agreements with both countries.

In 2022, the industry benefited from the full re-opening of hospitality businesses in key global markets, as well as the return of global travel retail which opens such an important window for Scotch Whisky to business and leisure travellers. Exports were also boosted by the continued premiumisation trend, with consumers attracted to high-quality spirits like Scotch Whisky, now often enjoyed in longer serves as well as the more traditional dram.

Looking ahead, the industry will have to continue to navigate economic headwinds, including global inflationary pressures, domestic energy and business costs, and a reduction in consumer confidence. With the right support from home governments, SWA is confident that the industry can continue to deliver for the Scottish and wider UK economy. SWA looks forward to collaborating with government and regulators on initiatives including sustainability and responsible drinking, alongside work to further boost exports, creating jobs and investment in communities across the country.

By reducing tariffs through the UK-India free trade agreement, continuing the duty freeze in the March budget, and ensuring the industry’s continued ability to advertise our world-class product in our home market, the Scottish and UK governments can count on the Scotch Whisky industry to reinvest its success across the UK.

Summary

· Export value of Scotch Whisky in 2022 was £6.2bn, up £1.68bn compared with 2021 and £1.28bn compared to 2019 (pre-pandemic).

Export volume of Scotch Whisky in 2022 was 1.67bn 70cl bottles (equivalent), up 291m 70cl bottles compared with 2021 and up 364m compared to 2019 (pre-pandemic).

On average, the equivalent of 53 bottles of Scotch Whisky are exported every second – up from 44 per second in 2021

· Scotch Whisky was exported to 174 global markets in 2022

· India overtook France to be the industry’s largest global market by volume for the first time - the volume of Scotch Whisky exports to India have grown by more than 200% in the past decade alone. India is the largest whisky market in the world but Scotch Whisky has just a 2% share of the Indian whisky market. The SWA believes that reducing the 150% tariff in India could increase the value of exports to the market by £1 billion over five years.

· The United States recovered to reach over £1bn of exports – the first time since the 25% tariff on Single Malt Scotch Whisky was suspended (£1.06bn in 2019)

· Bottled Blended Scotch Whisky accounted for 59% of value exports, with Single Malt 32% all Scotch Whisky exports by value.

Top 10 Markets

The largest export destinations for Scotch Whisky (defined by value) in 2022 (vs 2021) were:

· USA: £ 1,053m +33% (£790m in 2021)

· France: £ 488m +26% (£387m in 2021)

· Singapore: £316m +50% (£212m in 2021)

· Taiwan: £315m +39% (£226m in 2021)

· India: £282m +93% (£146m in 2021)

· China: £233m +18% (£198m in 2021)

· Panama: £203m +165% (£77m in 2021)

· Germany: £202m +36% (£148m in 2021)

· Japan: £175m +32% (£133m in 2021)

· Spain: £173m +46% (£118m in 2021)

The largest export destinations for Scotch Whisky (defined by volume, 70cl bottles equivalent) in 2022 were:

· India: 219m bottles +60% (136m bottles in 2021)

· France: 205m bottles +17% (176m bottles in 2021)

· United States: 137m bottles +9% (126 m bottles in 2021)

· Brazil: 93m bottles +14% (82 m bottles in 2021)

· Japan: 75m bottles +33% (56 m bottles in 2021)

· Germany: 67m bottles +48% (46 m bottles in 2021)

· Spain: 67m bottles +39% (48 m bottles in 2021)

· Poland: 49m bottles +9% (45 m bottles in 2021)

· Mexico: 48m bottles +2% (48 m bottles in 2021)

· South Africa: 39m bottles +15% (34 m bottles in 2021)

Regional Data

In 2022, Scotch Whisky exports by global region (defined by value) were:

- · Asia Pacific: £1818m +50% vs 2021 (29% of global exports)

- · European Union: £1596m +17% vs 2021 (26% of global exports)

- · North America: £1327m +32% vs 2021 (21% of global exports)

- · Central and South America: £737m +66% vs 2021 (12% of global exports)

- · Middle East and North Africa: £326m +74% vs 2021 (5% of global exports)

- · Sub-Saharan Africa: £204m +30% vs 2021 (3% of global exports)

- · Western Europe (ex EU): £146m +49% vs 2021 (2% of global exports)

- · Eastern Europe (ex.EU): £39m -18% vs 2021 (0.6% of global exports)

Category Data

In 2022, Scotch Whisky exports by category (defined by value) were:

- · Bottled Blend £3670m +43% vs 2021 (59% of global exports)

- · Single Malt £1986m +30% vs 2021 (32% of global exports)

- · Bulk Blend £190m +13% vs 2021 (3% of global exports)

- · Bottled Blended Malt £140m +22% vs 2021 (2% of global exports)

- · Bulk Blended Malt £130m +37% vs 2021 (2% of global exports)

- · Bulk Single & Blended Grain £58m +39% vs 2021 (1% of global exports)

- · Bottled

Single & Blended Grain £19m +150% vs 2021 (0.3% of global exports)

No comments:

Post a Comment