Whisky: Investing in Liquid Gold

Scotch whisky remains the global whisky superstar, putting all others in the shade. It is a drinks behemoth — the single most traded spirit on the planet and accounting for 75% of Scotland’s entire food and drink export revenue. The secret to Scotland’s success is its adaptability and today it is leading a move to premium whiskies. The global palate is becoming more refined and the value of the high quality Scotch single malt market is set to grow by over 11% a year to 2023.

Investing in Cask Whisky

One of the main reasons why a fine whisky cask appreciates in value is its ability to improve as it ages, unlike the average product which goes stale or simply expires, to quote from labels. In effect, when it comes to investing in whisky casks, time is your ally, much like investing on the Bourse in an identified quality stock. But when it comes to investment in a whisky cask, it may be the most important factor of all. In general, the longer you can leave it to mature, the richer you will be. The definitive word here is can. Every single cask in use, no matter its origin and handling, has a finite life, after which there will be negative Return on Investment. This facet defines the best age or time to sell your cask, as will be explained later. The cask could well be reworked and used again!

Producing whisky costs a lot, but one way distilleries capitalise on their efforts is to allow private investment. By investing in newly created whisky, the private investor can leave it to mature for as long as they like, making annual profits of 10% to 30% depending on how and where they market/sell it. Meanwhile, the distillery generates cash-flow to keep things ticking over.

Buying A Cask

If you were tempted to buy

your own cask of whisky as a means to “cut out the middle man” and to obtain

some bottles of whisky cheaply, stop reading here and head down to your local

liquor outlet instead. Commercially

available whiskies that you find in these outlets or in the online stores enjoy

economies of scale that are beyond the humble cask-buyer, and the journey of

buying, maturing, and bottling your own cask is not a path to cheap

whisky. So now that you’re considering

this for the right reasons…

Several Scottish

distilleries offer cask purchase schemes and, in fact, with the huge number of

new distilleries establishing and opening in the last few years, the

opportunities to buy your own cask are better than they’ve been for a long

time. Ardnamurchan, Glasgow,

Ballindalloch, Lagg, Annandale, Lindores Abbey, Kingsbarns, and Ardnahoe are

all just some examples of Scottish distilleries that have (or had) private cask

purchase offerings in place for individuals.

These smaller, privately owned distilleries need cash and investment up

front, and so offering casks as fresh fillings to the public is a nice way for

them to get the early injections of revenue they need. However, the cost and value varies

tremendously. For example, both

Ardnamurchan and Glasgow offered 200 litre ex-bourbon barrels for around

£2,500, whereas Lagg and Ardnahoe are currently charging £6,000 for the same

size barrel.

The schemes vary from

distillery to distillery but, in most cases, your original buy-in purchase

price will afford you somewhere between five and ten years of warehousing and a

sample sent out to you once a year. Additional fees and costs apply if you want to mature the cask and keep

it warehoused beyond the initial allowance, or to obtain extra samples.

According to The Whisky & Wealth Club, an organisation set up to connect investors with suitable whisky investments, investors purchased record palettes of the liquid gold in September. This boom at The Whisky & Wealth Club came as it sold 111.2 palettes of a new-make premium spirit for a total investment of over £1.8 million. This was nearly a 54% rise on its August sales.

Founded by Jay Bradley,

owner of The Craft Irish Whiskey Co, The Whisky & Wealth Club is a

specialised cask whisky wholesaler breaking down the barriers to entry in this

ancient industry. Although it’s technically called a club, the private

investors are not joining what has traditionally been an exclusive club for

industry insiders. Instead, The Whisky & Wealth Club pairs private

investors up with wealth advisors as a guide to suitable investment

opportunities in the whisky space. Much in the same way that a financial

advisor guides a retail investor on suitable investments for their SIPs. They

can then choose to buy, hold, bottle or sell their premium cask whisky as an

investment vehicle that suits their personal circumstances and whims.

Another reason whisky cask investing is popular is it

doesn’t incur VAT or Capital Gains Tax.

How Much Does a Whisky Cask

Cost?

The investment club or

broker strikes a deal with the distillery for a limited edition run at a

discounted price. The investor then buys a cask outright via the club. This is

then stored in a secure warehouse and insured. The investor patiently waits,

and when it’s time to profit from the deal, the investor should expect to enjoy

returns of up to 20%.

The cost of buying a cask

varies. Factors affecting price include brand, variety of cask used, distillery

location, and many more. The cheapest cask you may find could be around $2000,

but they can go upwards of $10,000.

One unique factor

affecting taste, and thus price, is the variety of casks being used. Scotch

whisky likes hand-me-downs and doesn’t respond well to being put in a brand new

wooden cask. So the most common and cheapest option is for it to be birthed in

a bourbon cask, often shipped from America to Scotland. A first fill is when a

cask, previously used to store Bourbon, is first filled up with whisky. A

refill is when that same cask is filled with whisky for a second or subsequent

time. Prices for these casks tend to start around the £2,500+ ($3,350) price

point. Of course, that’s not the only consideration, so prices vary wildly. A

cask that has previously contained sherry may well be double that and red wine,

dearer still. Then there’s the option for it to be peated, or unpeated, single,

double or even triple distilled.

|

|

So many options can be

overwhelming and that’s why an investment broker can keep you right. The Irish

Whiskey & Wealth Club and HMRC approved Whisky Investment Partners are just

two of many to choose from.

A Malt or a Blend?

Exclusivity Equals Profitability

Whiskies are not created equal, the cheaper ones are blends, containing only 10% to 20% of malt. True malt whiskies are a higher class and more appealing to investors. A unique brand expression, that’s not mass-produced, gives whisky its prestige and desirability. But the true value of a whisky comes from a selection of factors; age, quality, taste, brand, rarity and exclusivity all contribute to its worth.

That doesn’t mean all

blends are bad, though. Jack Daniels and Johnnie Walker are blends, but retail

investors can still buy exclusive bottles from these brands that hold their

value.

The Whisky & Wealth

Club’s unique selling point is its access to exclusive runs from top-notch

distilleries in Scotland and Ireland. An example of these exclusive runs is its

release of Bunnahabhain Staoisha in September. This hailed from an esteemed

Islay distillery and was limited to an undeclared number of casks. An average

whisky cask has a volume of 250 litres. This produces around 385 75cl bottles.

The pitch was perfectly curated and highlighted the reasons Islay whiskies in

particular are set to be a very valuable commodity in the future.

Whisky Investing Algorithm

In response to this

newfound demand for whisky investment options, financial analysts have gone so

far as to develop the very first data modelling algorithm. This is specifically

designed for investors in the whisky cask market. These analysts hail from specialist

whisky investment firms where they have the knowhow and experience to make

clear judgements on the market. The purpose of this algorithm is to furnish

prospective investors with a set of metrics that give them unique insight into

the industry.

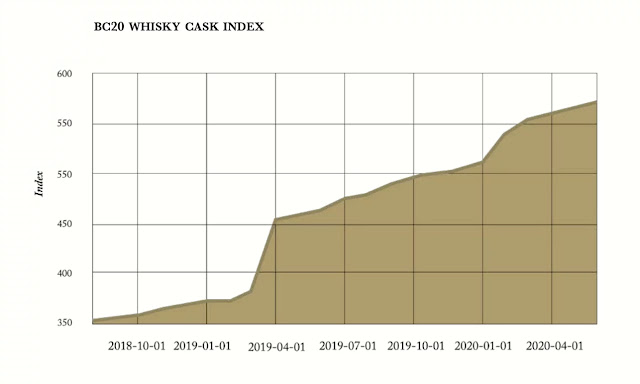

Braeburn Whisky is another

Whisky Cask Investment Specialist promising investors a fun, profitable and

fulfilling ride to investing in this intrinsically appreciating asset. It has

teamed up with Cask 88 to create its BC20 Whisky Cask Index. So far, this index

shows the whisky cask market to have a steady annual growth of around 13%.

Their recent research shows that whisky investment returns have surpassed that

of the S&P 500, Bitcoin (this may now be debatable) and Gold. Despite the

raging pandemic, this index continued to rise during the first six-months of

2020. Its data also shows that casks from the top three whisky distilleries

offer projected returns close to 20%. Islay whiskies showed a growth rate of

16.3% YOY.

According to its data,

Scotland has 22 million casks of whisky maturing in storage, giving it

confidence that trades will grow in quantity and cost. Gracing the top of the

Distillery Cask League Table is Laphroaig approaching 20% projected annual

capital growth. This is closely followed by Bunnahabhain, Staoisha and

Macallan. Malt whisky must mature for a minimum of 3 years to be called whisky,

but maturation periods can run upwards of 20 years. Due to the costs to store

the whisky, the more mature the product, the more expensive it will be.

In recent years the casks that have aged for over 20 years are achieving remarkable valuations. Casks aged over 45 years have sold for over £600,000. But it’s newly casked whisky (aka New Make Spirit) that younger investors are after because with time on their side, they can afford to reap big returns in the future.

The whisky maturing

process takes place in the cask. Once it’s been bottled it stops maturing and

that’s the age appearing on the label. This is why casked whisky over 20 years

old is considered rare and the older it is, the more valuable it becomes. In

2019 a rare bottle of Macallan 1926 sold for an extravagant $1.5 million!

None of the distilleries

followed by the BC20 Whisky Cask Index have shown negative returns. This is

because it’s a booming and lucrative area of investment to be in.

Irish Whiskey vs Scotch

Whisky

The Irish whiskey market

is rebounding and is projected to grow for the next two to three decades.

Scotch whisky is more established than the Irish whiskey market, with Scotch

whisky being a major contributor to Scotland’s food and drink exports,

accounting for 70% of them. This has a value of £4.7 billion annually to

Scotland. In fact 41 bottles a second leave Scotland’s shores, making their way

to 175 global markets.

Demand is growing and new

brands are entering the space. In recent years (prior to the pandemic) gin

popularity was exploding with new distilleries popping up all over the place.

Many of these make gin because production is quick. But a lot of them will also

branch into whisky production as a future income stream. So we can expect those

brands to come online in the years to come.

An example of this is Greenwood Distillers, a boutique distillery hidden in a misty valley in the

Scottish Highlands. This arm is called Ardross Distillery and it’s only begun producing its stylishly packaged ‘Theodore,

Pictish Gin’ this year, but has big plans to branch into creating rare,

exquisite and aged whiskies. It now owns some of the most unique single malts

Scotland can offer and has further plans to expand through Japan, the US,

France and Mexico.

Whisky: A Luxury

Investment

Whisky investing is taking

on a life of its own and very much up there with other favoured alternative

investments such as art, rare coins and fine wine. There are a number of cask

investment houses now making it easier for retail investors to jump on the whisky

bandwagon, but it’s important to avoid pitfalls too. While the middlemen make

the process easier, they can also cut into the profits. Nevertheless, these

cask wholesalers offer discounts to limited batches and exclusive runs.

This prospering industry

is not yet regulated, so it’s important to do your homework. There are trade

associations that legitimate investment firms can join to protect the

industry’s reputation. The Whiskey & Wealth Club works with a compliance

officer to ensure that its compliance-ready for when the Financial Conduct

Authority makes its mark.

Another risk is whisky

going out of fashion, but as it’s so ingrained in Scottish and Irish heritage,

which is spread throughout the world, that doesn’t look to be an imminent

concern.

When it comes to launching

a new whisky, an alternative route to branding is for the company to buy mature

whisky from investors, which it then brands as its own. This is one reason for

the increasing popularity of cask investing as it leads both parties to cash in

on the rising demand for these new and exciting brands.

Haig Club is a single

grain Scotch Whisky popularised by David Beckham in partnership with Diageo

(LON:DGE) and British entrepreneur Simon Fuller. Several other celebrity

endorsements quickly followed Beckham’s step into the whisky arena. Conor

McGregor has his own Irish Whiskey named Proper No. Twelve, after the area of

Dublin he comes from. Bob Dylan brought out a trio of whiskey blends, Metallica

have their own American Bourbon named Blackened, and Matthew McConaughey also

has a Bourbon called Longbranch.

In a 2020 report rare

whisky surpassed classic cars on the Knight Frank luxury investments index,

achieving its very own Knight Frank Rare Whisky 100 Index in the process. In

the luxury investments index, whisky has risen by 564% in value during the past

ten years.

Investing in Luxury Liquor

Brands

For investors looking to

diversify, it’s not just whisky that offers potential gains. The liquor market

is taking on a life of its own.

LVMH Moet Hennessy Louis

Vuitton SE, is a luxury goods conglomerate,

headquartered in Paris and distributed to every corner of the planet. Its share

price has grown phenomenally in the past decade generating spectacular

shareholder returns.

Bernard Arnault, chairman and CEO of $LVMH is now one of only five centibillionaires in the world. (A centibillionaire is someone who has personal wealth of more than $100 billion.) He joins ranks with Elon Musk, Jeff Bezos, Mark Zuckerberg and Bill Gates.

|

|

LVMH whisky brands include Glenmorangie and Ardbeg, while some of the other luxury goods under its label

include Tag Heuer, Moët & Chandon, Sephora, Louis Vuitton, Hennessy

(Cognac) and more recently it acquired Tiffany.

If you’d prefer to spread

your investment in luxury goods, across a selection of them, you could opt for

a luxury goods ETF. One such ETF is The GLUX – Amundi S&P Global Luxury

UCITS ETF – this tracks the S&P Global Luxury Index’s performance. Along

with LVMH, this includes Pernod Ricard SA (EPA: RI) a French drinks giant with

whisky brands that include Chivas Regal, The Glenlivet, Jameson and luxury

Scotch Whisky Royal Salute, it also owns many other alcoholic beverages.

Hollywood actor Ryan

Reynolds recently sold his premium gin brand to Diageo plc (LON: DGE) for $610m

(£460m). In striking the deal he agrees to be the face of Aviation American gin

for the next decade. Diageo is a fan of the celebrity endorsement, having

previously collaborated with George Clooney and David Beckham.

Diageo is another stock

that has rocketed over the past ten years. Its share price faltered in 2019 but

has been gaining ground during November. Whisky is such an important part of

Diageo’s portfolio, it’s committed to investing £185 million to revamp its

Scotch whisky visitor offerings at distilleries around Scotland.The highlight

of this is an immersive visitor experience at its Johnnie Walker, Princess

Street in Edinburgh, which tells the story of the brand.

Remy Cointreau SA (EPA:

RCO) creates premium spirits such as its opulent champagne cognacs. Its whisky

portfolio includes Bruichladdich single malts, Port Charlotte and Octomore, as

well as Westland American whiskey and Domaine des Hautes Glaces French whisky.

Remy’s share price rise has been more volatile over the past decade than LVMH

and Diageo, but long-term holders will still be sitting on a significant

profit.

Hidden Costs

The “hidden” or extra costs – and what catch so many people out – are the costs involved once the whisky is matured and deemed ready for bottling. Nine times out of ten, the purchase price you pay at the start covers only the cask and spirit up until it’s deemed ready to bottle. For whatever happens after that, the ball is in your court, as are the expenses. In the case of Scotch, the whisky must be bottled in Scotland, and so not only do you have to pay for bottling costs (in Great British Pounds, mind you, which is unlikely to favour your particular exchange rate), you also have to ship those bottles and all that extra weight of glass. Freight costs are determined by weight, and so in the case of a cask that yields, say, 250 x 700ml bottles, you’re paying to ship roughly 330kg of goods – of which 45% is just the weight of the glass! Printing and labelling costs also have to be paid for at the Scottish end (again, in pounds), and we haven’t even come to transport costs yet.

Then, there’s the biggie of them all – the cost of the duties, excise, taxes, and import costs to bring your whisky home to your own country. Take the case of Australia. Those that forked out, say, £2,500 to buy the cask at the start (roughly $4,600AUD) will be up for an additional $11,600 in local taxes (approx), depending on the bottling ABV! (The rough indication given here was based on 250 x 700ml bottles at a strength of 58% ABV). If you don’t have access to a genuine exporter who’s registered for UK VAT and Duty and can’t export under bond, then it’s likely you’ll also be up for the costs of all the UK excise and taxes (about an extra $6,400 based on the same assumptions as above), as well as those at your local end. And the costs of engaging a Customs broker to handle your Customs clearance still haven’t added in; the cost of freight itself (varies, but can be anywhere between $3 to $7 per bottle for sea-freight, depending on your carrier and what rate you can negotiate as a small, one-off player). Next, the additional costs of having to obtain a liquor licence (for importing a commercial quantity of alcohol) and – once it arrives here – space to hoard 250 bottles! And so, as many people have found to their surprise and dismay, what started out as a fun, sentimental venture ends up being an exercise that has become unaffordable. As a single player, doing a one-off exercise with a single bottling, the economies of scale simply do not exist.

Of course, many of these issues can be ameliorated by forming a syndicate and going in as a group. One person may struggle to deal with and pay for everything, but splitting a cask and its costs between, say, 20 or 30 people is a far more manageable affair.

Conclusion

Investing in whisky and

luxury liquor appears to be an interesting and potentially lucrative space to

be diversifying your financial investments. Just don’t be tempted to drink away

your profits!

Part 2 of this article follows.

A major portion of this post is a reprint of an article by Kirsteen Mackay on

Value The Markets

https://www.valuethemarkets.com/2020/11/20/whisky-investing-in-liquid-gold